Africa’s Energy Paradox: Vast Resources, Limited Electricity

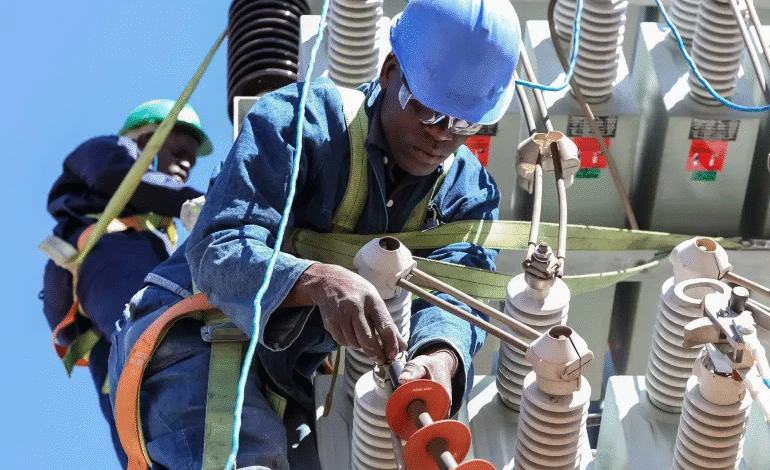

Despite major energy projects launched across Africa in recent decades—from large hydropower dams to expanding solar facilities—the continent’s electricity production remains far below the needs of its rapidly growing population. The gap between available resources and actual power generation continues to widen, revealing a structural challenge that slows down development across multiple sectors.

According to the International Energy Agency, Africa contributed only 3% of global electricity generation in 2023. Meanwhile, the average electricity access rate across 53 African countries stagnated at around 60.9% for two consecutive years. Power generation on the continent relies primarily on natural gas (41.7%), followed by coal (24.7%) and hydropower (18.4%).

Although Africa holds 60% of the world’s best solar potential, it received just 2% of global clean-energy investments in 2024—a striking indicator of the mismatch between its natural capabilities and actual investment flows.

A Widening Power Gap

Comparisons with countries of similar population size highlight the scale of the deficit. Spain, for example, produced around 290 TWh of electricity in 2023, while Sudan—despite having a comparable population—generated only 9 TWh. The situation is even more pronounced in the Democratic Republic of the Congo, which produced less than 8 TWh despite a population exceeding 110 million.

Globally, the contrast is sharper. The United States generates an average of 360 TWh every month, while China exceeds 10,000 TWh annually. The disparity underscores the limitations facing African economies.

Sudan and Ethiopia: Big Projects, Limited Domestic Impact

Before the conflict erupted in Sudan in 2023, hydropower supplied nearly half of the country’s electricity. Still, total generation capacity remained around 3.5 GW, forcing Sudan to import electricity from Egypt and Ethiopia to meet demand.

Ethiopia, despite completing the Grand Ethiopian Renaissance Dam and filling its reservoir, continues to struggle with domestic supply issues. Poor distribution networks, frequent flooding, and overloaded infrastructure hinder the delivery of electricity to vast rural areas. The national utility reported a generation capacity of 7,910 MW—boosted by major hydropower and wind projects—and strong revenues from electricity exports, yet full domestic coverage remains elusive.

Africa’s Top Electricity Producers

In 2023, South Africa remained the continent’s leading electricity producer with 229 TWh, followed by Egypt with 215 TWh. Algeria and Morocco occupied the next positions, while Nigeria ranked fifth with 40 TWh, and Libya sixth with 33 TWh.

Despite South Africa’s leadership, the country’s reliance on coal increased to about 80% of its generation mix between mid-2024 and mid-2025. Other African nations are slowly diversifying into solar, hydro, and natural-gas-based power.

Solar Energy: A Grassroots Solution

Africa produced only 21.5 GW of solar power in 2024—a modest amount compared with China, which added 8 GW in just five months. The shortfall is increasingly being bridged not by governments but by individuals and private companies. Solar panel imports from China surged by 60% to reach 15 GW, with 20 African countries recording record-high import levels.

This trend reflects a growing reliance on decentralised, off-grid solutions as communities seek alternatives to unreliable national grids.

Institutional and International Efforts

The African Development Bank launched an Energy Efficiency Index to evaluate the performance of 43 countries with formal regulatory frameworks. The 2024 results showed improvement in governance, tariff reforms, and public-utility performance in countries such as Kenya and Senegal.

International initiatives also played a role. The U.S.-backed “Power Africa” programme, for example, aimed to provide electricity access to 60 million homes and businesses, mobilising more than $54 billion in financing. Its conclusion in 2025 raised concerns about the continuity of global support for African energy development.

A Persistent Obstacle to Economic Growth

Limited electricity, combined with weak transport infrastructure, remains one of the biggest barriers to industrialisation in Africa. Without reliable power, manufacturing cannot thrive, pushing many countries to export raw materials instead of processing them locally. This reduces economic value, lowers competitiveness, and limits opportunities for millions across the continent.

Africa’s potential is immense, but without closing the electricity gap, sustainable growth will remain just out of reach.