The Times Warns: “Britain Is Bankrupt” Amid Mounting Debt Crisis Linked to Inflation-Linked Bonds

The Times newspaper issued a stark warning this week, declaring that “Britain is bankrupt.” While the phrase itself wasn’t directly stated in the UK’s Office for Budget Responsibility (OBR) report, the 65,000-word document leaves little room for doubt: the country is facing an unprecedented financial crisis.

The Root Cause: Inflation-Linked Bonds (Linkers)

At the heart of the problem lies a policy dating back more than 40 years. In 1981, the British government introduced inflation-linked bonds, known as “Linkers,” intended to protect investors against the erosion of capital due to inflation. While once seen as an innovative financial tool, the post-COVID inflation surge has turned these bonds into a massive liability for the UK Treasury.

Debt Costs Now Exceed Spending on Education and Defense

According to The Times, the cost of servicing public debt has soared from £25 billion ($32.3 billion) in 2020 to £105 billion ($135.6 billion) in the last fiscal year alone.

For context, the UK government spends approximately £60 billion on education, £55 billion on defense, and £20 billion on policing annually. The sheer scale of debt servicing now eclipses these essential public expenditures combined.

This dramatic spike is largely attributed to the Retail Price Index (RPI), which peaked at 14.2% in 2022, causing the value of Linkers to skyrocket. According to The Times, these bonds alone added £62.8 billion ($81 billion) in interest payments between 2022 and 2023.

A Clever Idea Turned Financial Trap

Originally issued during Margaret Thatcher’s government under Chancellor Geoffrey Howe, Linkers were designed to rebuild investor confidence after the economic turmoil of the 1970s. Their appeal lay in offering protection against inflation, which proved particularly attractive to pension funds seeking long-term real returns.

But the situation reversed post-2020. Britain now holds the highest proportion of inflation-linked debt among G7 nations — 25% of total debt, compared to 12% in Italy, 7% in the U.S., and less than 5% in Germany.

As a result, interest payments on British debt rose faster between 2019 and 2022 than in any other OECD country, and the OBR projects these costs will reach £132 billion ($170.4 billion) annually by 2030.

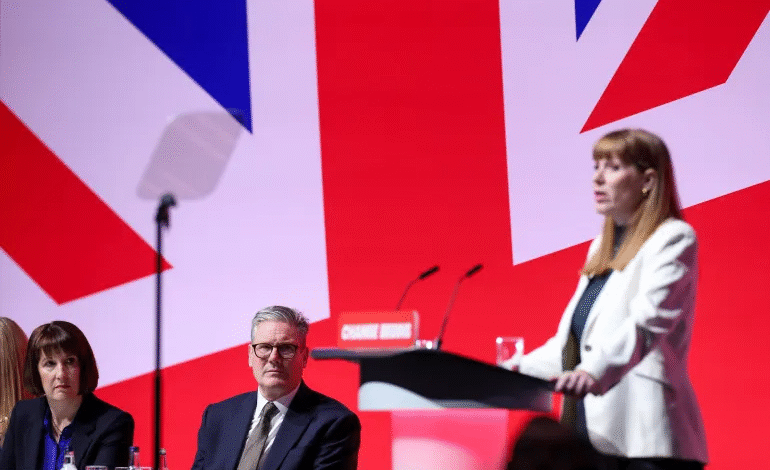

Rachel Reeves Handcuffed by the “Bond Vigilantes”

Chancellor Rachel Reeves now finds herself constrained by market forces. Investors, dubbed “bond vigilantes,” are carefully monitoring government moves and are likely to demand higher interest rates for any hint of fiscal loosening.

Treasury sources told The Times that past finance ministers were enticed by the low yields Linkers offered — despite repeated warnings of their long-term risks. The strong demand from pension funds made restraint difficult, with one official admitting:

“We simply went too far with these bonds.”

Who Is to Blame?

Though no single entity has been formally blamed, attention has turned to the Debt Management Office (DMO), a government advisory body created in 1998. It was headed until 2024 by Sir Robert Stheeman, who earned £145,000 ($187,000) annually. While he didn’t explicitly advocate for more Linkers, he consistently described them as a “cornerstone of the UK’s financing strategy.”

His successor, Jessica Pulay, continued to highlight “strong market demand” for Linkers, although the ultimate decisions lay with the government, not the DMO.

Back in the mid-2010s, the House of Lords’ Economic Affairs Committee warned of the fiscal dangers of relying too heavily on inflation-linked debt — a warning largely ignored at the time. Only in 2017 did the OBR begin issuing clearer warnings.

Hidden Policy Lever to Restrain Government Spending?

Leaked information cited by The Times suggests the Treasury may have used Linkers as a hidden tool to curb public spending. Since inflation increases the cost of servicing these bonds, any expansionary fiscal policy would automatically make additional spending politically and economically more expensive.

While this theory remains unproven, the paper asserts one fact is undeniable: Britain’s experiment with inflation-linked bonds has become a long-term burden that will continue to limit future Chancellors’ room for maneuver — and reshape the country’s financial policy for years to come.